us germany tax treaty interest income

Individual Capital Gains Tax Rate. When it comes to real property income the Germany US Tax Treaty provides that any income generated from the real property situated in one of the contracting states may still be taxed in that state in other words for example if a US person resides in the United States and has an income generated in Germany then Germany can still tax the income even though the person is.

Savings Investment Tips 10 Points On Public Provident Fund Ppf Investment What Every Indian Public Provident Fund Investment Tips Savings And Investment

Over 95 tax treaties.

. The United States Germany Tax Treaty covers double taxation with regards to income tax corporation tax and capital gains tax. The purpose of the treaty is to provide clarity for certain tax rules impacting citizens and residents of either country on matters involving cross-border income. Corporate Income Tax Rate.

Alongside income tax there is also a solidarity tax of a maximum of 55 of the income tax you owe. The complete texts of the following tax treaty documents are available in Adobe PDF format. Bank account by an American residing in Germany will be taxable in Germany under the USGerman tax treaty.

Corporate Capital Gains Tax Rate. A In the United States. US persons making payments withholding agents to foreign persons generally must withhold 30 of payments such as dividends interest and royalties made to foreign persons.

German national income tax law has been modified and superseded by various tax treaties with foreign countries to ensure that income is not taxed by more than one country. Summary of US tax treaty benefits. The German-American tax treaty has been in effect since 1990.

If you claim treaty benefits that override or modify any provision of the Internal Revenue Code and by claiming these benefits your tax is or might be reduced you must attach a fully completed Form 8833 Treaty-Based Return Position Disclosure Under Section 6114 or 7701 b to your tax return. Income tax on their worldwide income. If A is tax resident in Germany 76 of his pension will be taxed.

The German Federal Ministry of Finance BMF in January 2022 provided information on the current status of Germanys network of income tax treaties and treaty negotiations in annual guidance. This percentage increases up to 2020 by 2 per year and from then on by 1. Germany - Tax Treaty Documents.

The tax treaty serves to benefit citizens and residents from Germany who reside in the United States and vice-versa. Signed the OECD multilateral instrument MLI on July 7 2017. Germany currently has income tax treaties with 96 countries.

For example interest earned on a US. If the treaty does not cover a particular kind of income or if there is no treaty between your country and the United States. Rental income taxes are due to the country where the rental is located.

Treaty residents are subject to US. Article 11 of the United States- Germany Income Tax Treaty deals with the taxation interest. See Exceptions below for the situations.

Tax treaties generally reduce the US. Signed the OECD multilateral instrument MLI on July 7 2017. The German Federal Ministry of Finance BMF in January 2022 provided information on the current status of Germanys network of income tax.

Most income tax treaties contain what is known as a saving clause which prevents a citizen or resident of the United States from using the provisions of a tax treaty in order to avoid taxation of US. Return and a foreign tax credit can then be claimed. A receives in the year 2018 his US social security pension for the first time.

Under US domestic tax laws a foreign person generally is subject to 30 US tax on a gross basis on certain types of US-source income. This can lead to a double-taxation scenario if the foreign country where the person lives also imposes an income tax. And bb the excise tax imposed on insurance premiums paid.

Taxes of residents of foreign countries as determined under the applicable treaties. German income tax rates are relatively high compared to the US so for many people it will make sense to claim the Foreign Tax Credit. The existing taxes to which this Convention shall apply are.

However DTTs have not been concluded. It does however stipulate that income from interest dividends and royalties will only be taxed in the country where youre a resident so if you have this type of income it may be beneficial for you to claim a treaty provision when you file. 24 will be tax-free.

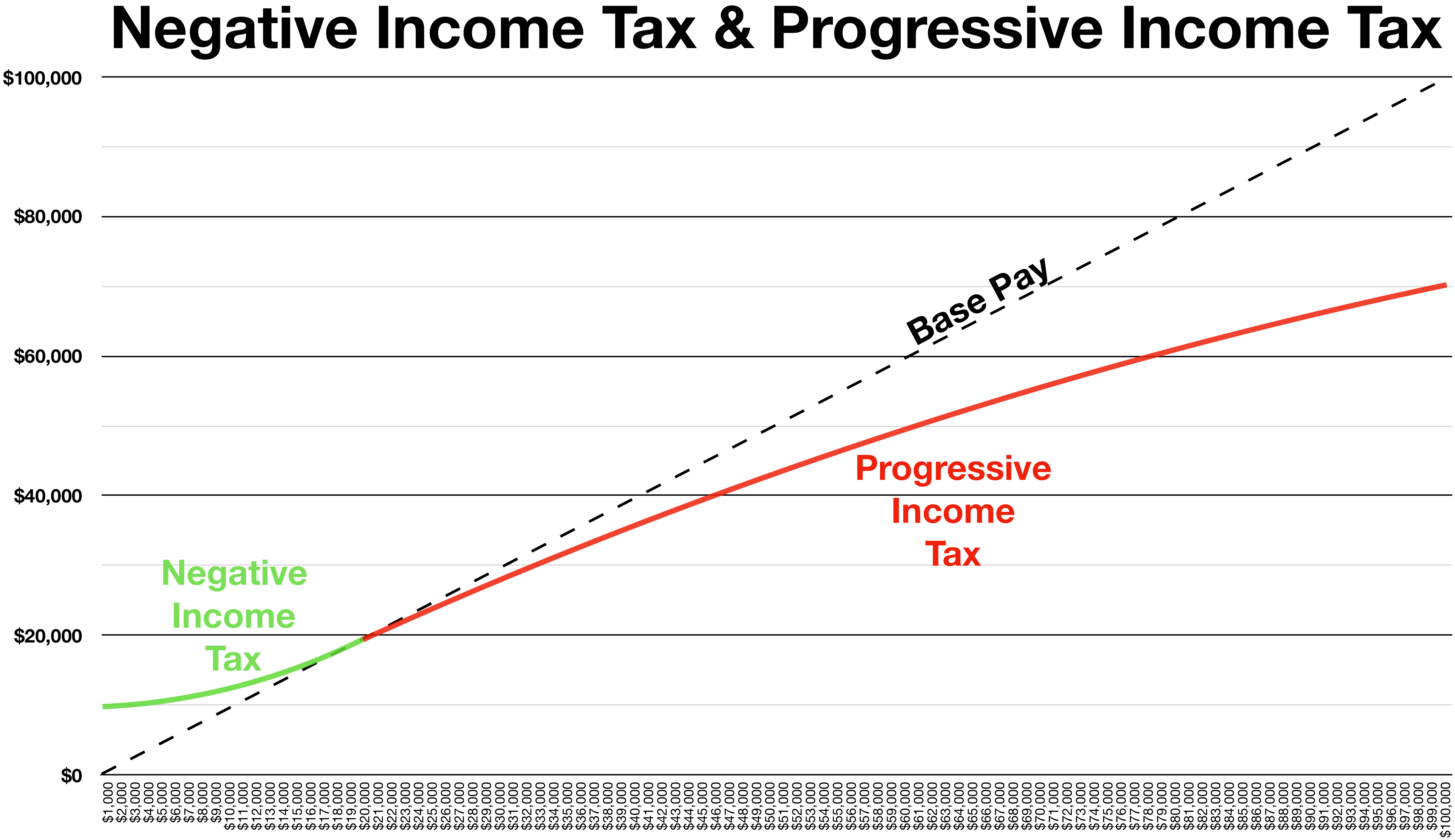

Progressive rates from 14-45. A In the United States. In the year 2040 the percentage will be 100.

The income tax treaty dated 1 July 2010 with the United Arab Emirates UAE ceased to. Article 11 1 of the United States- Germany Income Tax Treaty generally grants to the State of residence the exclusive right to tax interest beneficially owned by its residents and arising in the other Contracting State. Tax Rates on Income Other Than Personal Service Income Under Chapter 3 Internal Revenue Code and Income Tax Treaties Rev.

Germany has concluded DTTs applicable for income taxes with nearly 90 countries amongst them most of the industrialised countries. For further information on tax treaties refer also to the Treasury Departments Tax Treaty Documents page. The income must also be reported on the US.

Aa the federal income taxes imposed by the Internal Revenue Code but excluding the accumulated earnings tax the personal holding company tax and social security taxes. If you have problems opening the pdf document or viewing pages download the latest version of Adobe Acrobat Reader. To help minimize double taxation the United States government has negotiated reciprocal tax treaties with a number of foreign nations such as Germany.

The United States and Germany entered into a bilateral international income tax treaty several years ago. This table lists the income tax and withholding rates on income other than for personal service income including rates for interest dividends royalties pensions and annuities and social security payments. Unfortunately the US-Germany tax treaty doesnt prevent Americans living in Germany from filing US taxes.

On June 1 2006 the United States and Germany signed a protocol the Protocol to the income tax treaty between the two countries as amended by a prior protocol the Existing Treaty. There is not a wealth tax in Germany but inheritance tax varies from 7 to 50 based on the value of the inheritance. Real estate capital gains are only taxed if the property was not occupied by the owner and was held for under 10 years.

With certain exceptions they do not reduce the US. Most importantly for German investors in the United States the Protocol would eliminate the withholding. Convention between the United States of America and the Federal Republic of Germany for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with respect to Taxes on income and Capital and to Certain Other Taxes together with a related Protocol signed at Bonn on August 29 1989.

We strongly recommend that if you have any doubts or. Interest paid to non-residents other than on convertible or profit-sharing bonds and. German income tax rates range from 0 to 45.

The 7 Best Languages For Business How To Speak Spanish Language Learn Mandarin

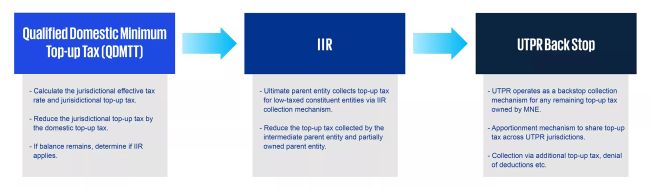

The Brave New World Of Global Minimum Taxation Corporate Tax Malta

Nri Can Use Double Tax Avoidance Agreement Dtaa To Save Tax Nri Saving And Investment Tips Investment Tips Savings And Investment Investing

Laos To Implement New Income Tax Rates Income Tax Lao Peoples Democratic Republic

Doing Business In The United States Federal Tax Issues Pwc

Germany United States International Income Tax Treaty Explained

Do You Need To Pay Tax When You Transfer Money To India From Overseas Bank Nri Banking And Savi Savings And Investment Investment Tips Public Provident Fund

Germany Tax Revenue 1991 2022 Ceic Data

Income Tax In Germany For Expat Employees Expatica

United States Germany Income Tax Treaty Sf Tax Counsel

Claiming Income Tax Treaty Benefits A Nonresident Tax Guide

What Is The U S Germany Income Tax Treaty Becker International Law

Taxation In The United States Wikiwand

France Tax Income Taxes In France Tax Foundation

Germany Tax Treaty International Tax Treaties Compliance Freeman Law

Is It Mandatory To Declare Foreign Bank Accounts And Assets In Income Tax Return By Nri Nri Saving And Inv Income Tax Savings And Investment Investment Tips

Pdf German Tax System Double Taxation Avoidance Conventions Structure And Developments